Apple is not perfect but if there is a hardware selling company out there that knows how to keep fluctuating order levels filled while keeping inventory low, Apple is that company. Even when I was with them back in the day, our just in time ability was usually A+. There was always a heavy emphasis on low inventory.

Not surprising to see Samsung riding with that much inventory. As mentioned, these kinds of outsized earnings drops relative to revenue is very tellingly on their corporate business strategy. But! There is an upside specifically for the cognitive reasoning challenged (just kidding) who opt for a Samsung, they might be able to find a deal on a Galaxy where Samsung will pay you to take it.

. Riding with high inventory levels is usually the third rail to corporate philosophy and Wall Street.

Yep, no chance Samsung Display (iPhone fueled) success can offset this. Samsung Electronics two divisions that make up the most revenue are Mobile and Semi. If those two sink? There financials are going to crater. I’d bet, though not sure, it would be like Apple iPhone and Services categories cratering but iPad has a big upswing. That’s great for iPad but iPhone and Services revenue are way too big to be made up by a much smaller revenue earner.

No kidding, Samsung Display should be going after all Apple’s business. I read Apple is looking elsewhere (LG, etc) and think “why isn’t Samsung doing everything they can to expand Apple’s business”). To that, Samsung Semi should be going after Apple Silicon too. They’re not in the right position at this very moment but they are one of the biggest foundries in the world. Hundreds of millions of SOCs (higher revenue chips) along with even more legacy chips, plus the chance at the upcoming Apple modem chip. Plus this way they can now honestly say they are building the best smartphones in the business.

.

.

.

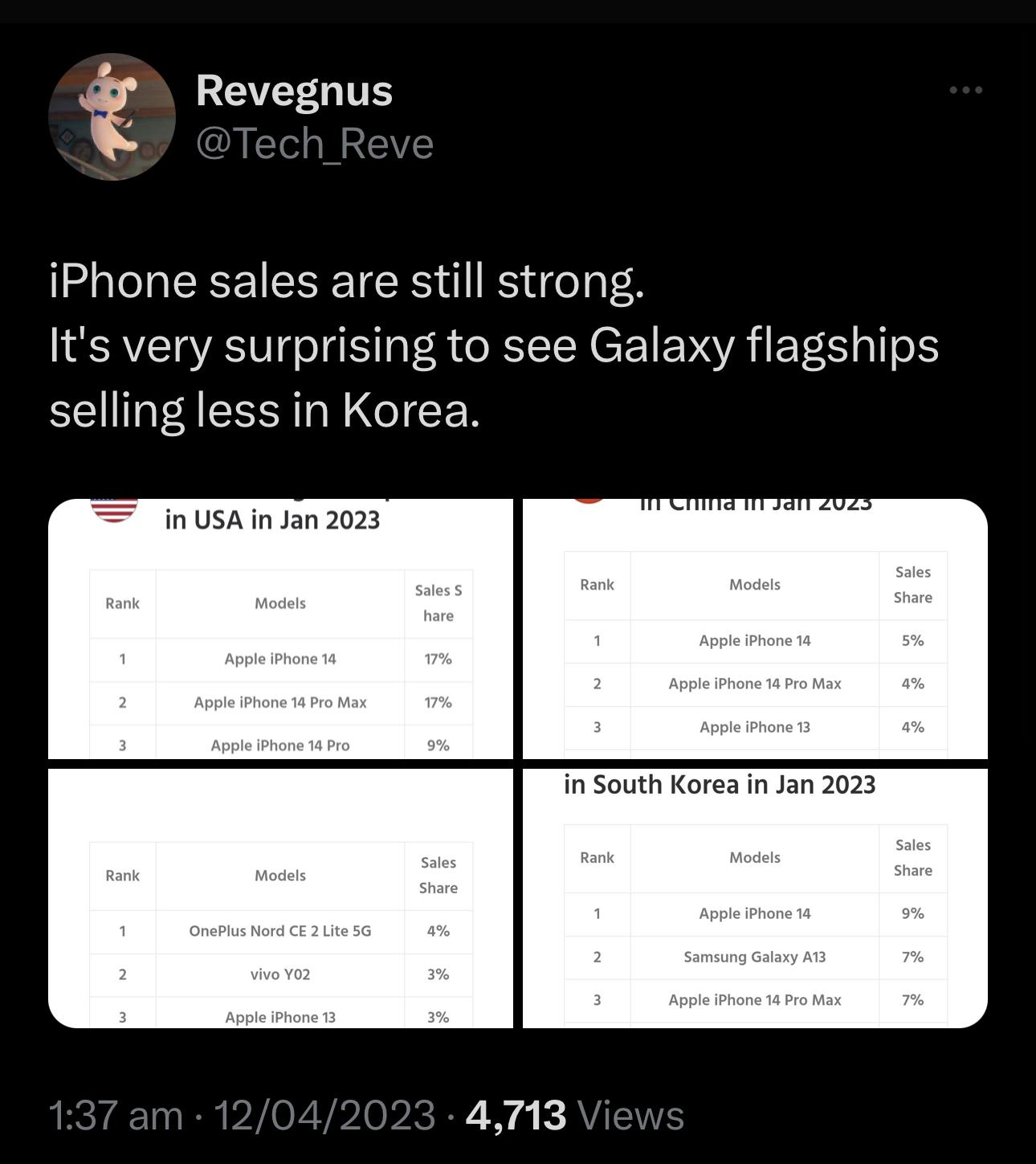

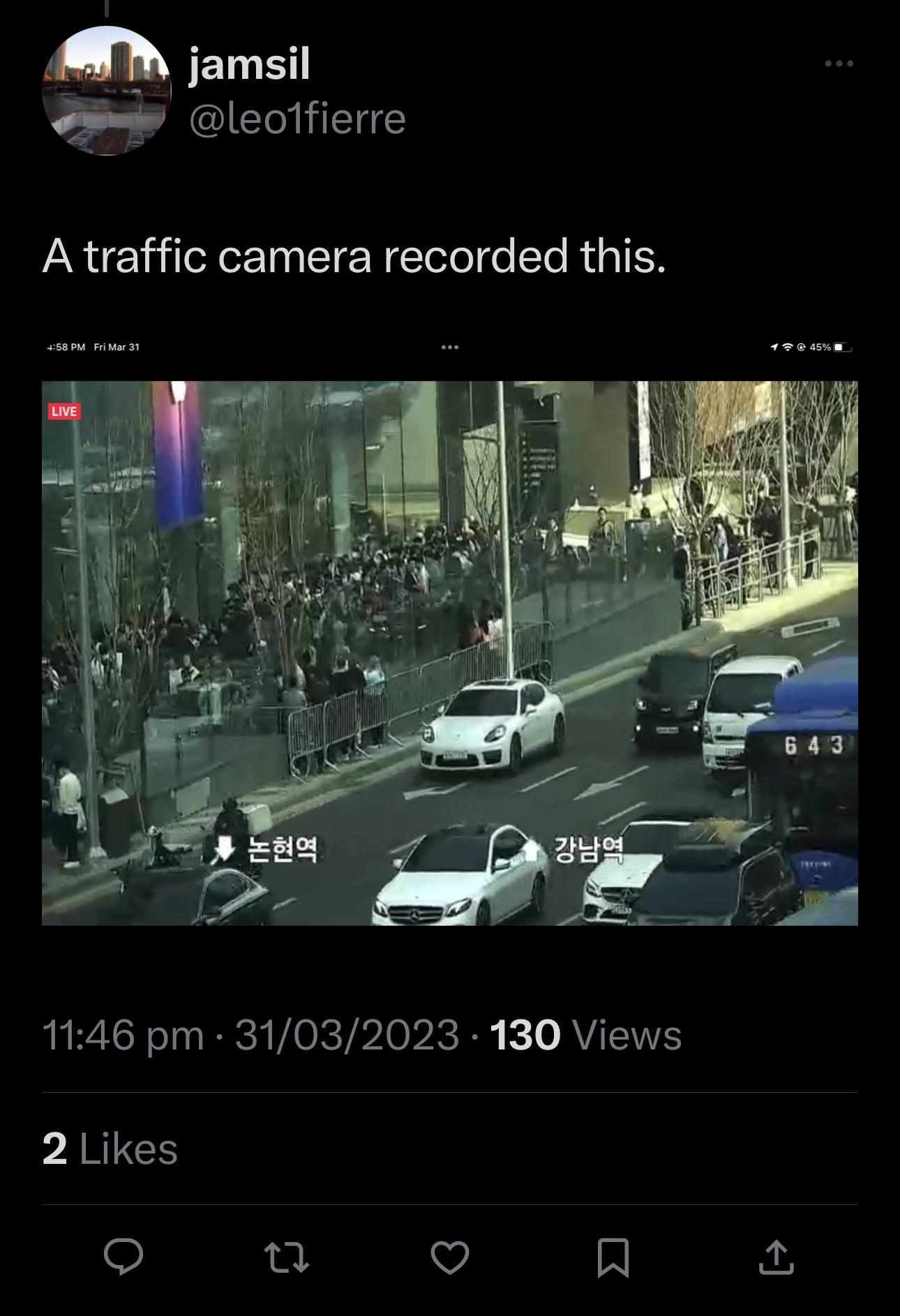

. Q1 numbers are in with apple at 21% and Samsung 22%. Samsung down 2% you and the iPhone up 3%.

. Q1 numbers are in with apple at 21% and Samsung 22%. Samsung down 2% you and the iPhone up 3%.